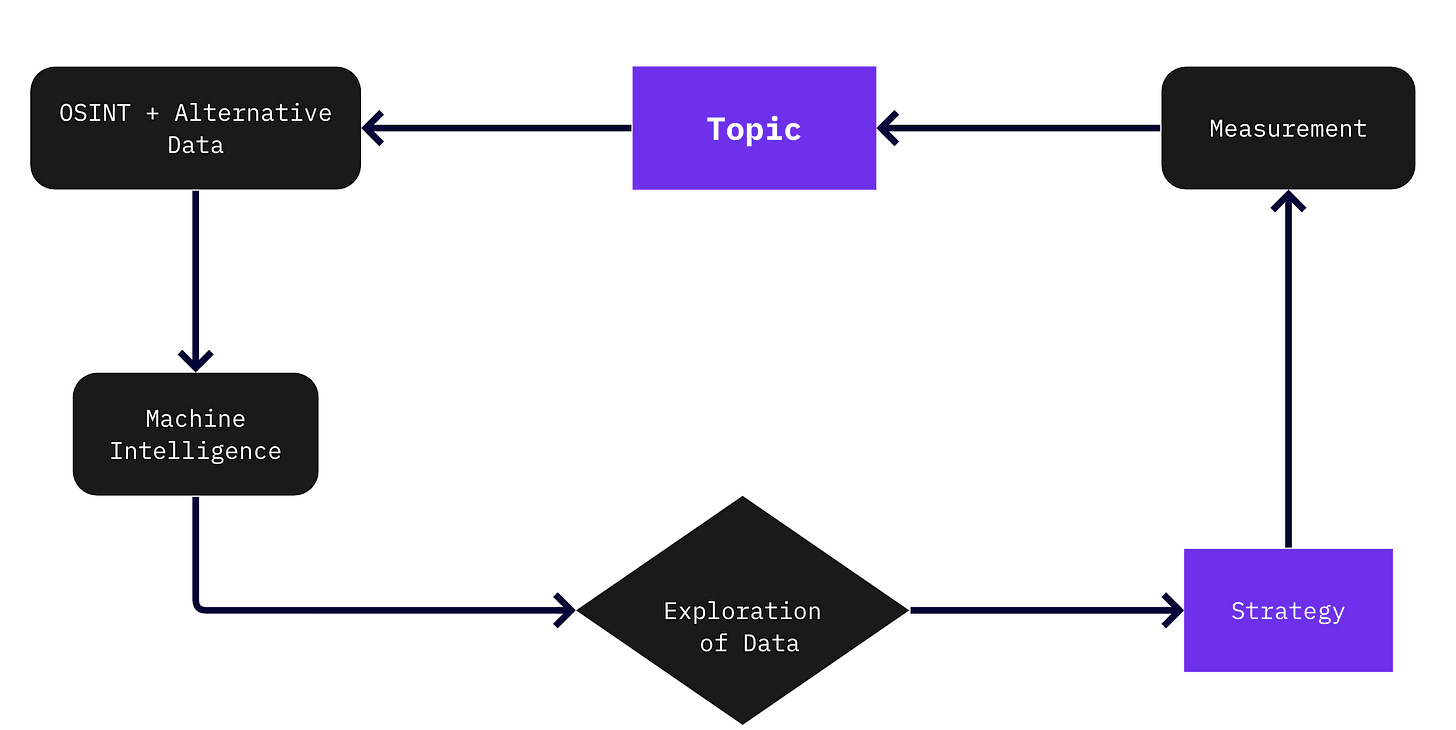

Since 2009, bridge_ci has been utilizing a proprietary methodology known as domain analysis to gain a deeper understanding of risks, opportunities, and markets. What sets domain analysis apart from traditional strategy-making is its use of machine intelligence, OSINT, and alternative data to extract insights from millions of data points. By analyzing all available information on a given topic or issue, rather than just a few news articles or data points, domain analysis provides a more comprehensive and nuanced view of the subject at hand before making massive investments.

Domain Analysis Flywheel

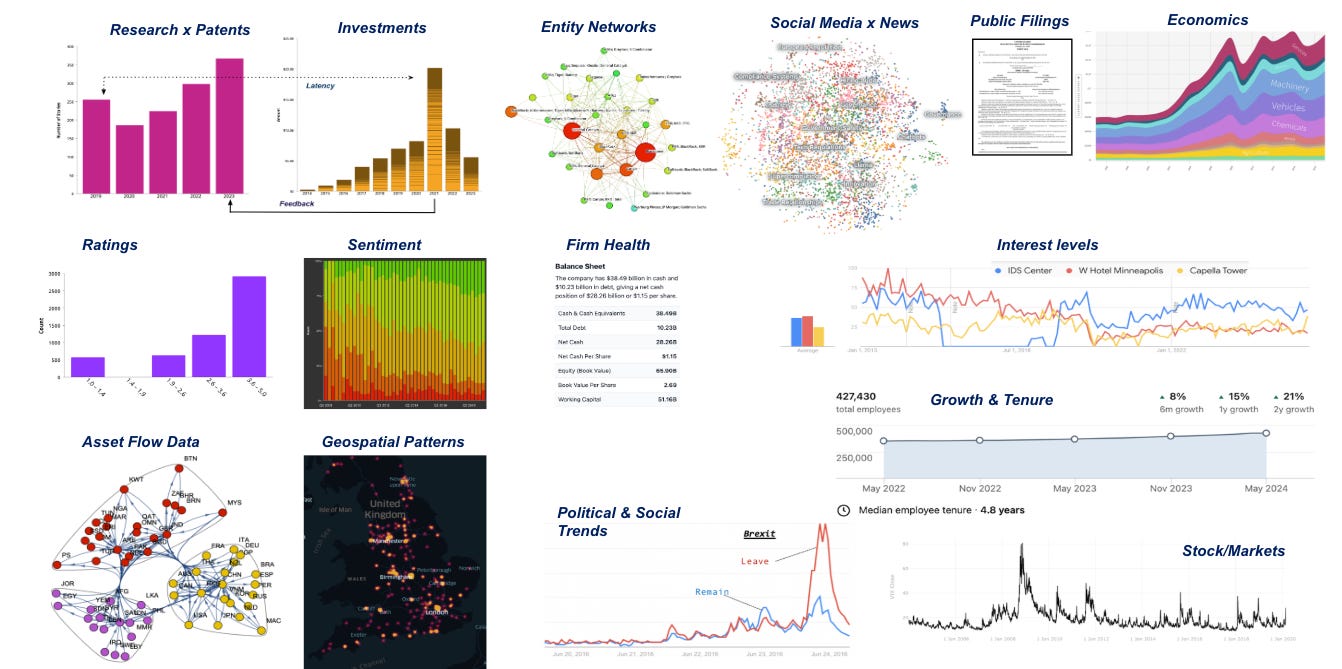

Another advantage is versatility. Domain analysis can be applied to a wide range of business verticals, from private equity and public affairs to corporate strategy and mergers and acquisitions—essentially any field where identifying topical themes and subthemes is vital for understanding the market. By providing deep insights and actionable data-driven intelligence from the outset, domain analysis helps businesses make informed decisions and maintain a competitive edge.

OSINT & Alternative Data

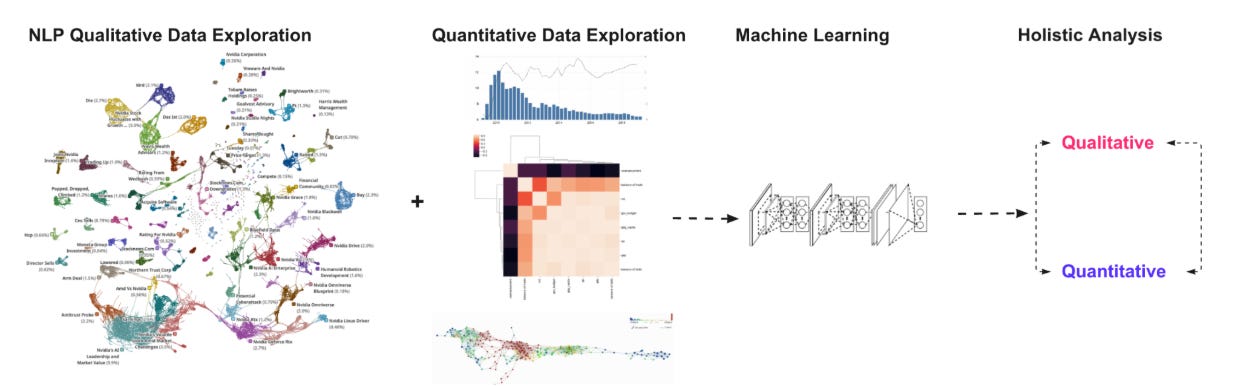

Furthermore, when all data on a given topic or trend is analyzed using tens of thousands of data points and machine learning consistently ranks everything, it removes biases and echo chambers. By measuring political, regulatory, market, or social trends analytically rather than relying solely on intuition, we are able to provide a more objective and accurate assessment of the situation or goal. This is particularly valuable for "soft" trends such as political, regulatory, or social risk, which traditionally have been difficult to quantify using conventional methods.

Combine Quantitative and Qualitative Insights

The process harmonizes and weights both qualitative and quantitative signals from internal, open source intelligence and alternative data across millions of data points using advanced algorithms, providing unprecedented insights for decision-making across all areas of an enterprise.

Can be applied to grey business application e.g. structured/unstructured strategic questions

Systemic statistical analysis - know what is actually driving or inhibiting your firm’s revenue

Can link insights to a enterprise wide agentic decision architecture to automated decision making- similar to a quant hedge fund

Domain analysis represents a fundamental shift in how modern organizations navigate complexity and uncertainty. By leveraging machine intelligence, OSINT, and alternative data to map the intricate networks of relationships between markets, competitors, regulations, and social trends, organizations gain the ability to see their entire operating environment in context—not as isolated data points, but as an interconnected system. This holistic approach transforms decision-making from reactive to predictive, enabling leaders to identify emerging risks months before they materialize and uncover opportunities hidden in the convergence of disparate signals. In an era where every company must become a technology company, domain analysis provides the critical capability to process millions of data points, eliminate cognitive biases, and stress-test strategic hypotheses before committing resources.

As global regulatory complexity intensifies and market dynamics accelerate, organizations that embrace domain analysis gain not just operational efficiency—with typical reductions of 30-40% in compliance costs and 60-70% gains in monitoring efficiency—but a decisive competitive advantage through early signal detection, precise resource allocation, and the ability to shape rather than merely respond to change. The future belongs to organizations that can transform overwhelming complexity into strategic clarity through systematic, data-driven domain analysis.